FUND FACT SHEET

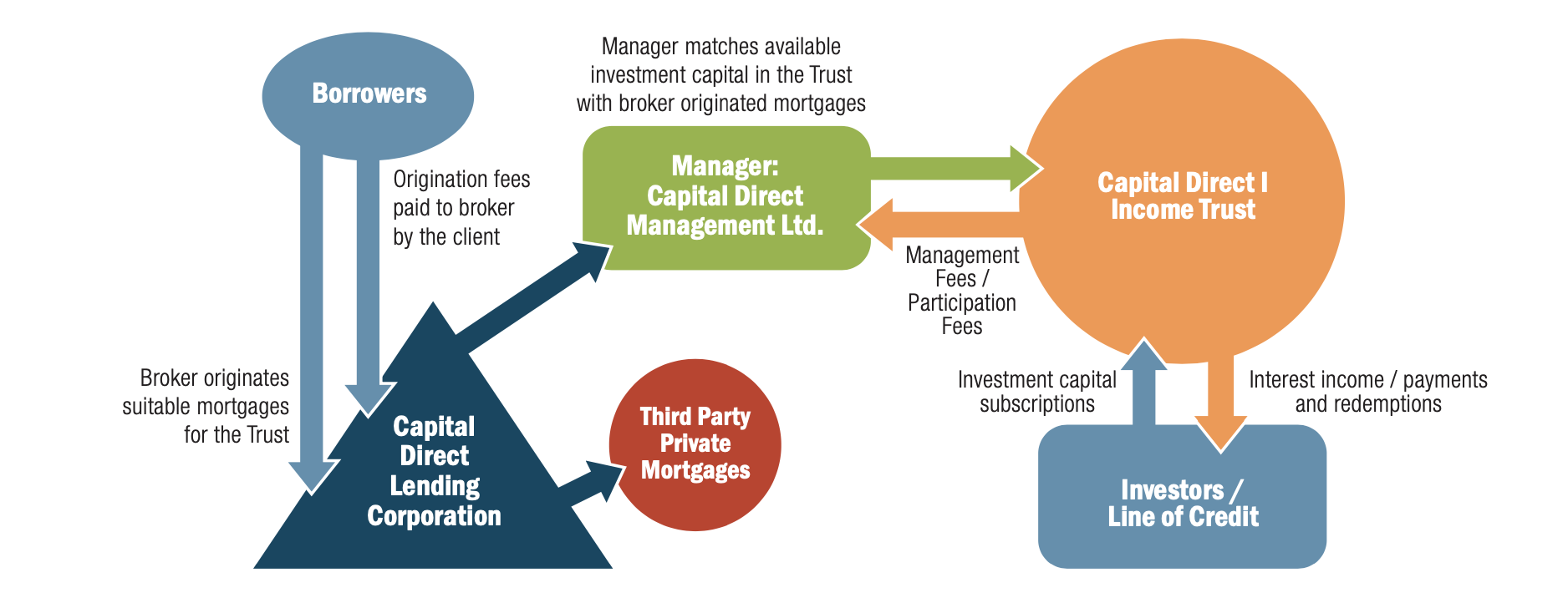

Capital Direct I Income Trust is an open-end investment trust governed by the laws of Ontario. The trust is a pooled investment vehicle that holds a portfolio of residential mortgage loans to generate stable distributions to unitholders.

FUND FACT SHEET

FUND OVERVIEW

Capital Direct I Income Trust is an open-end investment trust governed by the laws of Ontario. The trust is a pooled investment vehicle that holds a portfolio of residential mortgage loans to generate stable distributions to unitholders.

INVESTMENT HIGHLIGHTS

Preserve Capital (1)

Generate Quarterly Income for Investors

Stable $10 Unit Value

FUND DETAILS OF CAPITAL DIRECT I INCOME TRUST (as of September 30, 2024)

| Manager | Capital Direct Management Ltd. |

| Fund Type | Open-ended Investment Trust |

| Inception Date | June 2006 |

| Minimum Investment | $5,000 |

| Term of Mortgages | Limited to 2 years maximum |

| Distributions | Quarterly |

| Dividend Reinvestment Plan (DRIP) | Yes |

| Class A Annualized Return for Q3 2024 |

9.03% (2) |

| Mortgage Type | Residential |

| Weighted Average LTV | 53.7% |

| Registered investment Qualified (TFSA, RESP, RRSP, RRIF) |

Yes |

| Total Assets | $475 Million |

| Geographical Diversification | BC, AB, ON, Atlantic |

| Trustee | ComputerShare Trust Company of Canada |

| Closings | Monthly |

| Analyst Rating | 2- (Very Good Return to Risk Ratio) (3) |

Unit Class

AC

Commission

1.5%none

Trailer

1%1%

Management Fee

2% Net Assets2% Net Assets

Income Participation

20% Maximum20% Maximum

Redemptions

MonthlyMonthly

REDEMPTIONS

Class A and C: Units are retractable by written notice not less than 21 days prior to the last business day of any month in any year at a retraction price equal to the declared but unpaid Return plus the Net Assets Value per Unit subject to the following charges:

Class A

Time of Redemption |

DSC Charge |

|

Prior to the 1st Anniversary of Acquisition After 1st Anniversary but before 2nd Anniversary After 2nd Anniversary but before 3rd Anniversary After 3rd Anniversary but before 4th Anniversary After 4th Anniversary but before 5th Anniversary After 5th Anniversary of Acquisition |

5% 4% 3% 2% 1% 0% |

Class C

Time of Redemption |

Short Term Trading Charge |

|

Within the 1st 180 Days of Acquisition After 180 Days |

2% 0% |

Capital Direct I Income Trust Annual Rate of Return

Net of Management Fee + Income Participation (4)

All investments carry risk. Past performance is not an indication of future returns.

(1) Management’s assessment, based upon loss history and loan to value ratio.

(2) Annualized return is based on Q3 2024 income produced by the Class A Units of the Trust.

(3) Fundamental Research Corp., May 2024.

(4) Annual return is based on income produced by the assets of the Trust in that year after any voluntary reduction in Management fees or Income Participation. Annualized quarterly return (indicated by "Q") is based on income produced by the assets of the Trust in that quarter.

PORTFOLIO SUMMARY

Loan-to-Value (LTV)

Loan-to-Value (LTV)Calculated as Financing outstanding divided by the value of security pledged.

Weighted Average LTV

53.4%

| < 45% | 24% | |

| 45 - 54.9% | 20% | |

| 55 - 64.9% | 33% | |

| 65 - 74.9% | 20% | |

| 75 - 89.9% | 3% |

Term to Maturity

Term to MaturityThe remaining number of months until the principal of a mortgage is scheduled to be repaid.

| < 24 months | 22% | |

| < 18 months | 17% | |

| < 12 months | 33% | |

| < 6 months | 28% |

Security Position

Security PositionPlace in line held by the Fund should a borrower default.

| 1st | 57% | |

| 2nd | 41% | |

| 3rd | 2% |

Location of Mortgages

Location of MortgagesGeographically diversified mortgages primarily within 90 km of major urban areas.

| BC | 40% | |

| Ontario | 39% | |

| Alberta | 15% | |

| Atlantic | 6% |

OVERVIEW

Capital Direct Management Ltd.

555 West 8th Ave. Vancouver,

British Columbia. V5Z 1C6

Tel: 604-430-1498

Fax: 604-430-3287

Toll Free: 1-800-625-7747

Email: [email protected]

Tim Wittig

Senior Vice President/Director

Phone: 1-800-625-7747

Email: [email protected]

Barbara Insley

Chief Compliance Officer

Capital Direct Financial Ltd.

Phone: 1-800-625-7747

Email: [email protected]

Back Office Administrator

121 King Street West, Suite 300,

Toronto, ON, M5H 3T9

416-967-0038 option 1

or 1-888-967-0038

General Processing Fax:

416-967-1969

This document does not provide disclosure of all information required for an investor to make an informed investment decision. Investors should read the current offering memorandum, especially the risk factors relating to the securities being offered, prior to making an investment decision. All subscriptions for the purchase of units are made pursuant to available prospectus exemptions. Depending on the exemption being relied upon, an investor will receive the appropriate risk acknowledgement together with the most recent offering memorandum. Sales of units in all Provinces and Territories of Canada may be made through Capital Direct Financial Ltd. or a Dealer/Advisor.