The Capital Direct I Income Trust opens select opportunities to investors like you. Share in the success we've built since 2006. You can take advantage of our proven mortgage and real estate expertise.

Capital Direct is one of the fastest growing, non-traditional private lending companies in Canada specializing in home equity and residential mortgage financing. To find out more about Capital Direct, visit our retail web site at www.capitaldirect.ca.

Find out how you can take part in Capital Direct's investment of choice.

Warren Buffett once said, “if you don’t find a way to make money while you sleep, you work until you die.”

That’s harsh, but the Oracle of Omaha doesn’t lie. Consider that $1 million invested at 7% a year generates more annual income than the median Canadian household makes working 9 to 5s. Historically, people who learn how to generate passive income successfully see their income – and wealth – snowball over time.

Apply now to see how Capital Direct can help you create passive income.

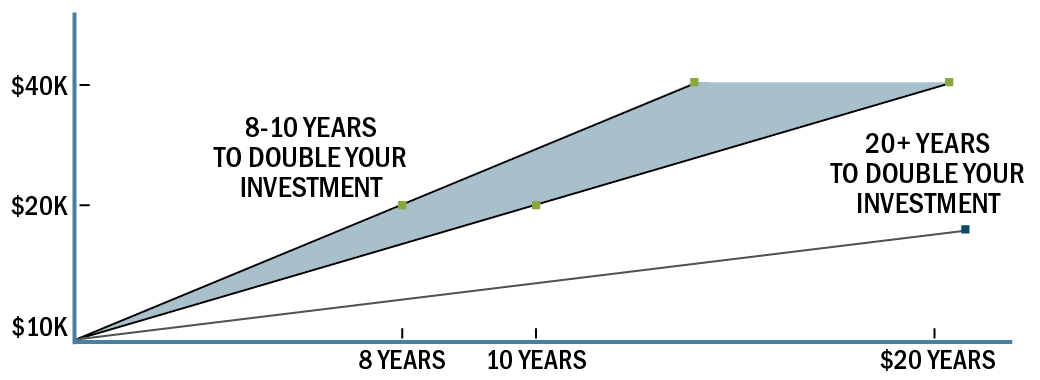

With better investing, your plans can become reality sooner than you might think. Investment options offered by banks may not grow fast enough to achieve your financial goals.

Capital Direct I Income Trust contains a blend of mortgages carefully selected based on stability, security, and financial worth.

The Capital Direct I Income Trust is 100% RRSP, RRIF, RESP & TFSA eligible. It is an ideal investment for your medium and long term goals.

Participate in an investment option

that takes advantage of the strength of the real estate market and offers attractive returns. Whether you are saving for retirement, a child's education, or simply want your registered or non-registered savings to grow, the Capital Direct I Income Trust can put your savings into high gear and help you achieve your goals. This is an investment you will be proud to tell your family and friends about!

* Actual time to double your investment may vary as the annualized rate of return varies.

What People Say

I saw your advertisement on TV and liked what I saw. I have received decent returns over the years. I have already told a lot of people and relatives about my investments and returns.

Don B, Montrose, BC | July 1, 2025

Low LTV weighted average, very good analyst rating, timely redemption opportunities. I have felt positive and pleased with performance since investing in 2021. I feel it is a very good return and growth considering the recent downtrend/drop in the Bank of Canada interest rates. My company contacts are easily reachable and quick with answers to my questions. I appreciate the care that Tim Wittig and Éire Gorman provide, very satisfied and very much appreciated.

Eva C., Duncan, BC | June 2, 2025

* Annual return is based upon Q1 2025 income produced by Class F Units of the Trust after voluntary reduction by Management in Income Participation and distribution.

** Annual return is based upon Q1 2025 income produced by Class A and C Units of the Trust after voluntary reduction by Management in Income Participation and distribution.

Past performance is not an indication of future returns. All subscriptions for the purchase of units are made pursuant to available exemptions. Investors should read the offering memorandum, especially the risk factors relating to the securities offered, before making an investment decision.